The View – April 2024

Our new Office Manager - Bhav Patel, view from a starter

Bhav seamlessly became a part of the Charterhouse family back in December 2023, transitioning from the bustling world of FX in Farringdon, where, in her role as a Talent and Engagement Co-ordinator, she excelled, to her new role as our Office and Administration Manager, keeping the ship sailing smoothly.

But there is so much more to Bhav, when she’s not conquering administrative mountains, she’s on epic adventures with her mini-me, her daughter. Together, they’re a dynamic duo, exploring every nook and cranny of London. Despite hailing from the north, they’re still uncovering hidden gems even after a decade in the big city. With their sights set on global domination, there’s no stopping this unstoppable pair!

And there’s a hidden gem that makes Bhav an even better fit for Charterhouse: her love for all things green! With a passion for environmental sustainability, she was able to make an immediate impact, helping the team to achieve the prestigious Gold CSRA Accreditation. Bhav’s commitment to a greener world aligns perfectly with our values, making her an invaluable addition to our family.

There’s one more thing: when Bhav first joined, she expected a sea of boring accountants, but oh, was she mistaken! The fun, relaxed, and friendly environment at Charterhouse took her by surprise, and she’s been loving every moment since.

Hear what Bhav and other new starters had to say about the firm and what it is like to work here.

St Luke’s Hospice Harrow – what does 2024 have in store for our Charity of the Year.

With spring firmly in the air now we are all looking forward to summer and with St Luke’s that means looking at how they can help their patients and their families enjoy the fresh air to help with their care. Over the past couple of years they have been developing the gardens with the latest project being a nature walk to allow the patients to wander through some beautiful natural landscapes.

As part of our support for the hospice we have decided to sponsor an area of the garden and our team will be working with the St Luke’s maintenance team to prepare an area of the garden and then maintain it throughout the year. Watch this space for updates on how the garden area is developing.

We are also working with the Charity and the local college to host a fashion show where the students will get the chance to design outfits using some of the thousands of garments that have been donated. The event promises to be an amazing occasion, supporting the local community to give the students new opportunities whilst at the same time helping the hospice.

Local businesses and people will be invited to attend the show being held at the hospice outlet and warehouse, but numbers are limited so if you do want to join us get in touch soon.

We are also continuing all of our ongoing work with the charity, helping to raise their profile and in doing so raise the funds needed to continue providing their amazing service.

To find out more about these activities and our other support for St Luke’s please read our website or contact us.

MTD – Plans to role out to sole traders and landlords

As far back as 2019 Making Tax Digital (MTD) has been mandatory for all VAT registered businesses with a turnover above £85,000 and at that time we were preparing for all our affected client’s businesses to complete their VAT, corporation tax and income tax for self-assessment (ITSA) returns online, hopefully reducing the reliance on HMRC resources and reducing any delays.

Over the past few years HMRC have been requiring more businesses to switch to digital platforms and now it is the turn of Landlords and Sole Traders.

But don’t panic, the requirements do not come into force until 2027, although it is worth starting the transition process now.

As of April 2027, HMRC will extend MTD to landlords and sole traders with income over £30,000. However, whilst one of the main reasons for introducing MTD was to streamline the process there are now concerns that the extension of MTD for the self-employed will only exacerbate delays.

The next step for HMRC will be to move all self-assessment returns online, with MTD for Income Tax Self-Assessment (ITSA) set to replace the current system, meaning landlords and the self-employed will also need to submit statements quarterly too.

Before April 2027, HMRC has confirmed that all businesses and landlords earning over £50,000 will have to join MTD for ITSA from April 2026. This threshold will then fall to £30,000 from April 2027.

According to a recent article in The Telegraph HMRC expects that around 780,000 people with business or property income over £50,000 will join MTD for ITSA from April 2026, with a further 970,000 people joining from April 2027. Rather than saving people money as first muted, the article suggests that the total amount landlords and business owners will have to pay to join the MTD club is around £196m a year, equating to £110 per business on subscriptions and software in order to comply with HMRC’s digital tax drive. There is also likely to be a one-off transitional cost, approximately £350 for each business as well.

Richard Wild of the Chartered Institute of Taxation said the latest figures are “evidence of a growing recognition by HMRC that the ongoing financial costs of MTD to business are much higher than they originally estimated, and those now in scope should expect to incur ongoing costs rather than generating efficiency savings.”

The Spring Statement – what did it mean for us all

Will this be his final Budget? Jeremy Hunt hopes not, he mentioned all those that had lobbied him and be bought their constituents’ votes with the changes he announced!

Nothing new in this Budget, as is the norm these days, we read it all in the weekend papers!

What were the main highlights?

Wycombe Homeless Connection – Winter Update

Wycombe Homeless Connection’s vision is to see South Buckinghamshire transformed into a place where no one is homeless and that there is suitable homes and housing security for all.

As we enter the winter, their services are changing, not least as despite everyone’s best efforts, more people are sleeping rough in the south of Bucks than anyone hoped would be. Their support centre in Wycombe and their homelessness helpline is open daily and due to an increase in need they have just doubled the amount of help they are offering in Chesham as one in six of the people they help already come from the town.

The BSU (Business Support Unit) unveils it’s new website

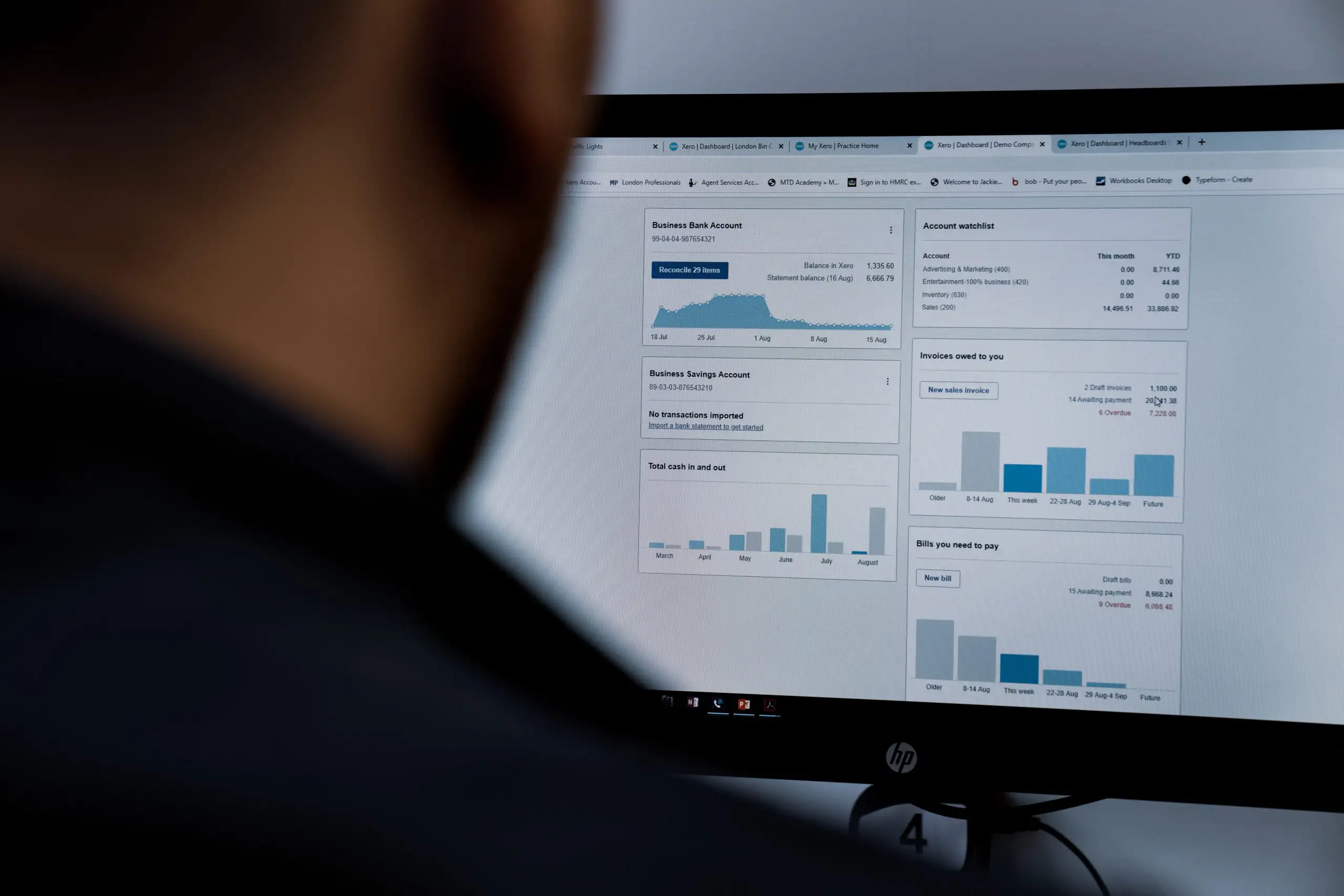

Outsourced financial management at a price you can afford, delivering growth for your business.

As a firm Charterhouse have always provided more than just accounting services and over the recent years we have realised that SME’s often struggle to find the right expertise all the time, to oversee their financial management.

The Charterhouse Business Support Unit (BSU) has been set up to deliver just this, financial management to suit your business and at a price you can afford, without the hassle. From basic tax returns and year end accounts for sole traders to the complete outsourcing of your financial function for the more established businesses, we can support you.

We have recently launched a new website that provides information on all the services we offer so you can see how easy it is to ensure you can have the most cost effective resource by using our expert team, allowing you to fully focus on growing your business.

To find out more about how the BSU can help you and your business please contact Rob Ward or have a look at the website www.thebsu.net